Our Best Refinance Offers Ideas

Wiki Article

A Biased View of Refinance Deals

Table of ContentsBest Refinance Offers Can Be Fun For Anyone5 Easy Facts About Best Refinance Offers ShownThe Best Refinance Offers IdeasLittle Known Questions About Best Refinance Offers.Top Guidelines Of Best Home Loan Refinance Offers

That car loan is used to repay your present mortgage, preferably replacing it with far better terms for your lengthy- or short-term objectives. You won't be alone if you decide to re-finance (best refinance offers). In mid-September, refinanced car loans accounted for nearly one-third of all mortgages, according to a current weekly study from the Mortgage Bankers OrganizationBelow are some major benefits of re-financing your home mortgage: If you can cut your current home loan's passion rate by at least 0. If you can cut the number of years left on your financing, it can save you thousands in interest expenses (also 10s of thousands).

A fixed-rate mortgage means the rate of interest is established for the life of the loan. Refinancing to obtain a fixed rate will provide you an established monthly settlement. Many loan providers require for debtors that can not pay for at the very least a 20% deposit for their home mortgage. If you have actually been in your home long sufficient to develop that much equity (or if your home's value has increased) you might be able to re-finance and have the PMI went down from your regular monthly bill.

The smart Trick of Best Home Loan Refinance Offers That Nobody is Discussing

75% interest price, you'll conserve more than $200,000 on the overall car loan's cost. If you refinance a 30-year fixed-rate mortgage with an additional 30-year fixed-rate financing after numerous years of making repayments, you'll end up paying much more in total passion.

Be certain to whether refinancing is ideal for you before continuing. Keep in mind to determine what your total settlement may be in the future in addition to just how much the closing costs and costs for the refi loan mood cost savings overall. For certified debtors, it's a good concept to shop around.

Use the table listed below to begin. Lastly, any kind of home loan application process can be made complex. Refinancing while rate of interest prices are increasing might make it much more so. Make certain to speak with a home mortgage refi expert or economic advisor to assist. Many thanks for reading CBS INFORMATION. Produce your free account or log in for webpage even more features.

Unknown Facts About Best Refinance Deals

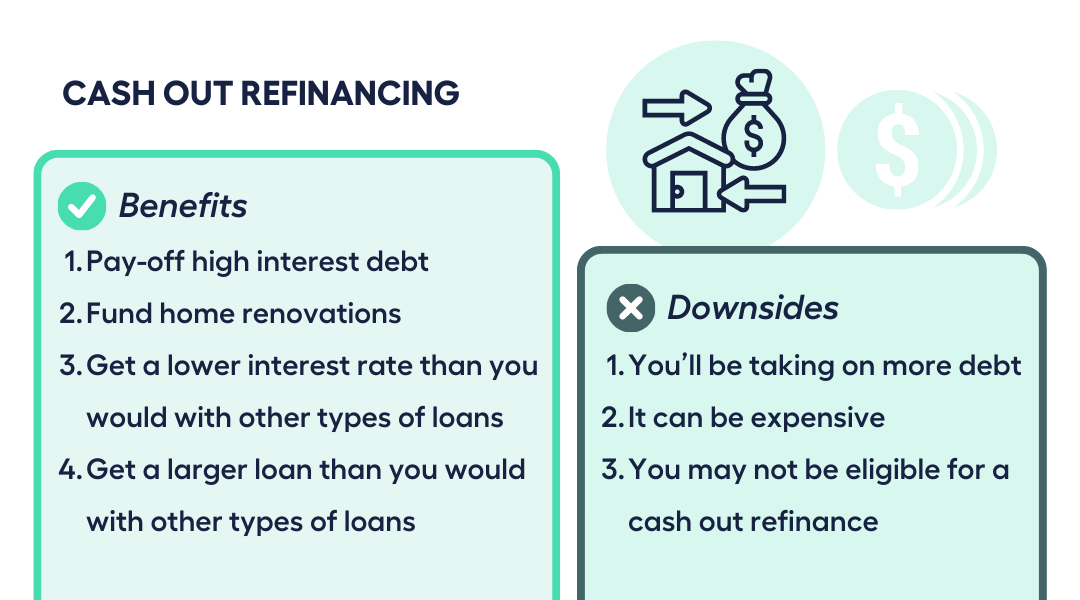

Refinancing your home loan may have a number of prospective advantages: It can lower your month-to-month principal and passion settlement or it could help you pay off your mortgage faster. You'll wish to evaluate any costs connected with the refinancing, as well as the new interest rate of your car loan, to identify if a refinance might make good sense.If you had actually 22 years left on your initial loan, you might be able to refinance by picking a 15-year or 20-year home loan. It's important to assess the effect this might have on your month-to-month principal and rate of interest payment.

Talk with a home loan consultant to review your options. This approach may aid decrease the quantity of interest you pay with time. However it is necessary to consider your full economic photo. If you have monetary challenges after you end up being a homeowner, your home loan lending institution may have the ability to find choices that can aid you.

This can mean refinancing to a lower interest rate or refinancing to a different home loan term. Refinancing a home is a major monetary decision and one that shouldn't be made without doing all the research study.

Best Home Loan Refinance Offers Can Be Fun For Anyone

You can secure your price in with your loan provider. When you refinance, you're essentially changing your original mortgage loan with a brand-new one which indicates you have to pay closing costs again.

A few of the various other costs you may need to pay consist of a title search fee, an examination fee, flood qualifications, tape-recording charges and lawyers' costs. These fees can quickly raise the cost of a refinance by Continue a number of hundred bucks or even more. The number one reason that many individuals re-finance is to get a lower rate of interest on their home mortgage.

Flexible rate car loans can conserve you cash in the temporary yet they can be dangerous if your payment unexpectedly soars as a result of a price change. The same is true if you've got a HELOC that's approaching the end of its interest-only payment period. content When you have to start paying off the principal, you might see your repayments boost considerably which can place a significant stress on your budget.

What Does Best Refinance Offers Mean?

When you're trying to decide whether to refinance, the very best point to do is experience the numbers (best refinance offers). Determine just how much you'll conserve and whether it's worth the charges you'll need to pay. If the closing prices are a fairly high, it'll take you longer to recover the costs in savingsReport this wiki page